Coinbase’s recent registration with India’s Financial Intelligence Unit (FIU) marks a pivotal moment not just for the exchange, but for the entire crypto market in India and, by extension, Asia. After a turbulent exit in 2023 due to regulatory headwinds, Coinbase is back—armed with compliance, strategic intent, and a keen eye on the region’s rapidly evolving digital asset landscape. This move is more than a simple re-entry; it signals a potential paradigm shift in how global crypto players engage with Asia’s most populous democracy.

Why Coinbase Chose This Moment for India

The timing of Coinbase’s return is telling. The Indian government has softened its previously hardline stance against crypto, even as it enforces one of the world’s steepest 30% tax rates on crypto gains. Regulatory uncertainty remains—the country still lacks comprehensive digital asset legislation—but the mood has shifted. Coinbase’s FIU registration is not just about compliance; it’s about seizing an opportunity as India reviews its stance on cryptocurrencies, influenced by evolving global and U.S. policies.

This bold move positions Coinbase to tap into a market of over 1.4 billion people—half of whom are under 30 and increasingly tech-savvy. The demand for crypto trading platforms is surging, despite—or perhaps because of—regulatory ambiguity. For Indian investors weary of domestic exchanges’ limitations or security concerns, Coinbase offers not only global credibility but also advanced trading features and institutional-grade security.

How Coinbase Could Disrupt Local Crypto Exchanges

The competitive landscape is set for disruption. Until now, local exchanges like WazirX and CoinDCX have dominated the scene—often hamstrung by banking restrictions and fragmented regulation. With Coinbase’s regulatory approval in India, the bar for transparency, security, and user experience will rise sharply.

Key Differences: Coinbase vs. Indian Crypto Exchanges

-

Regulatory Compliance: Coinbase emphasizes strict adherence to global regulatory standards, while many Indian exchanges operate within local regulatory frameworks that are still evolving.

-

Supported Cryptocurrencies: Coinbase offers a broader selection of digital assets compared to most Indian platforms, which often limit listings due to regulatory caution.

-

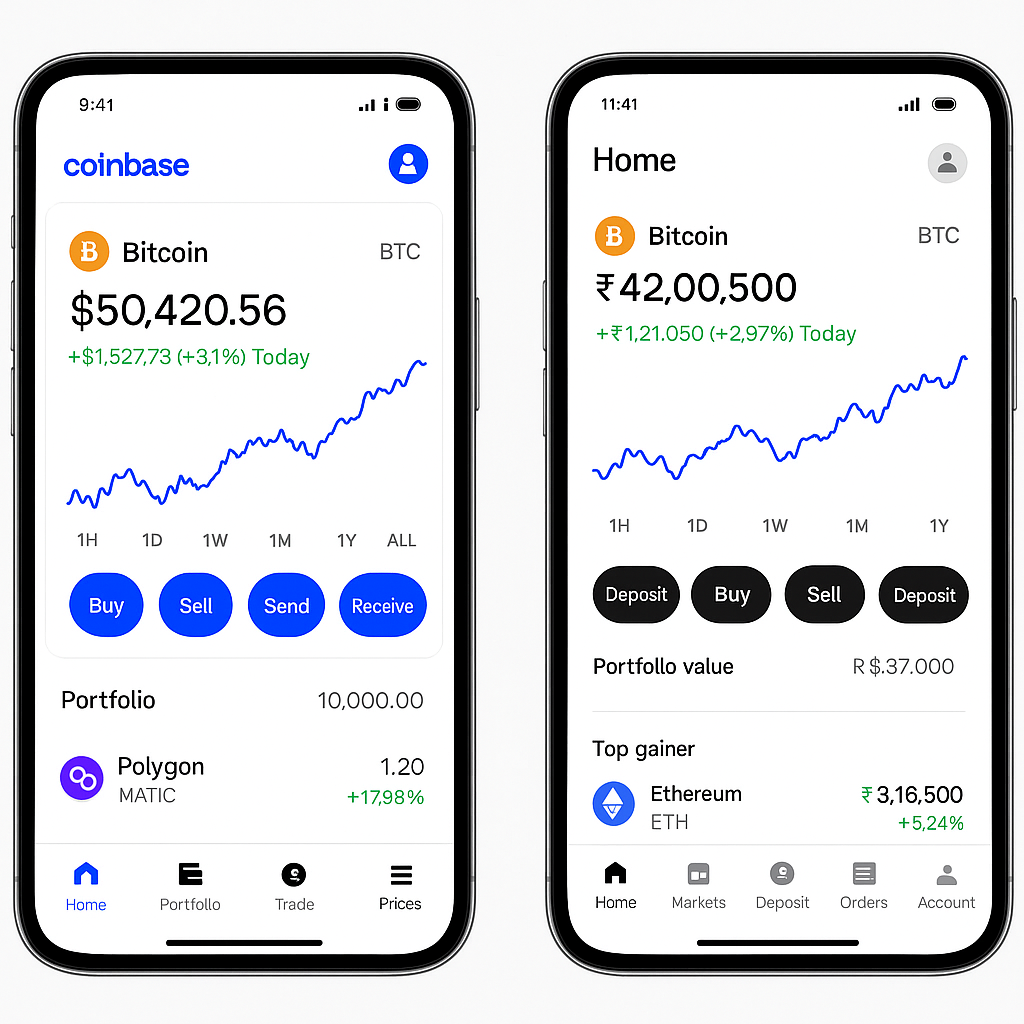

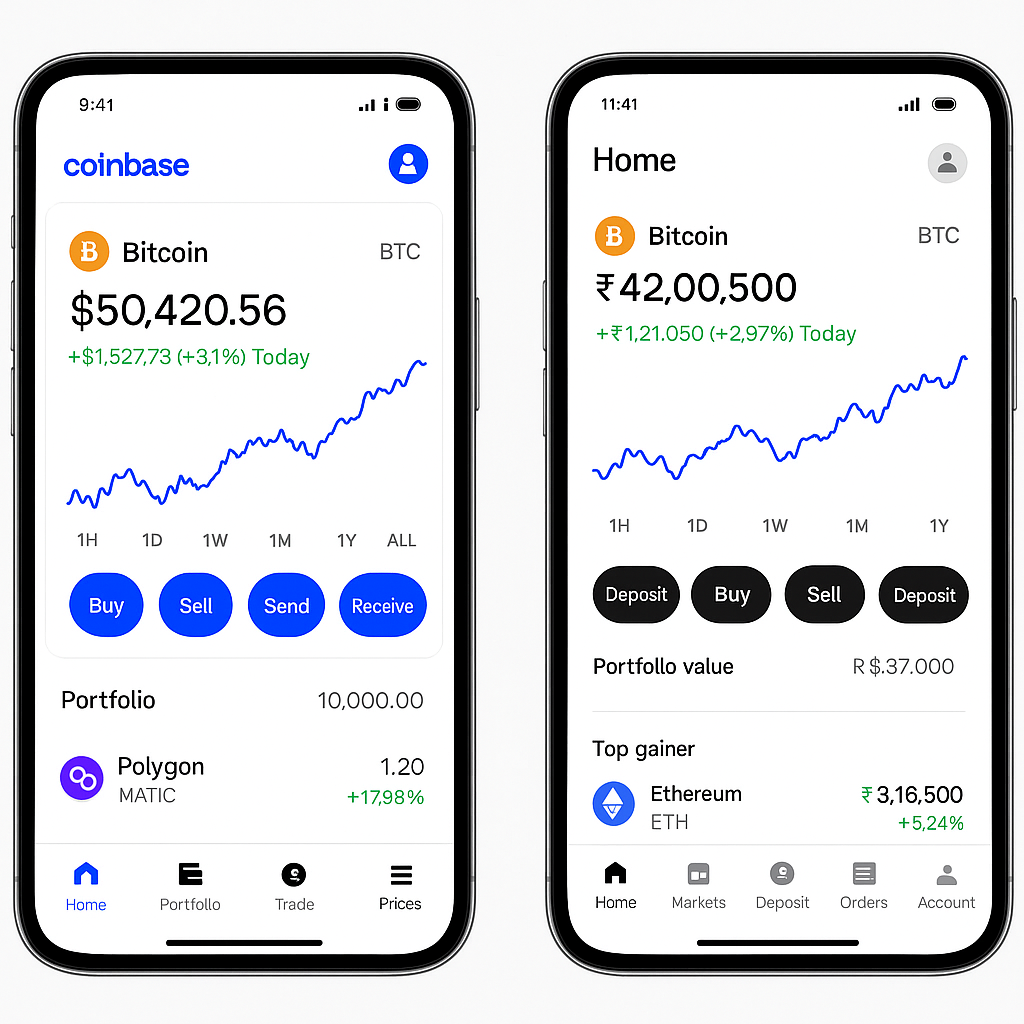

User Interface & Experience: Coinbase is known for its intuitive, user-friendly interfaces, whereas Indian exchanges may prioritize advanced trading features for local users.

-

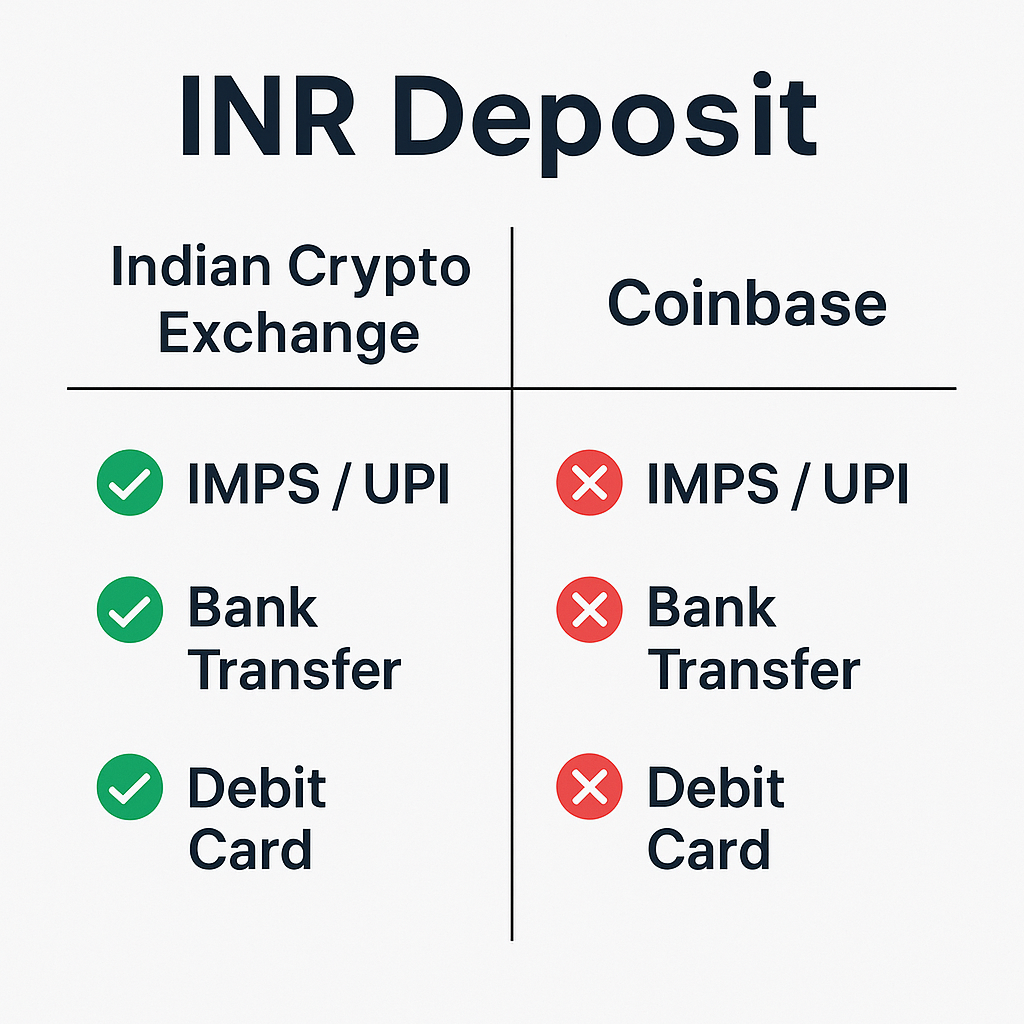

Fiat On-Ramp Options: Indian exchanges typically provide direct INR deposit and withdrawal options, while Coinbase’s fiat services in India are more restricted or indirect.

-

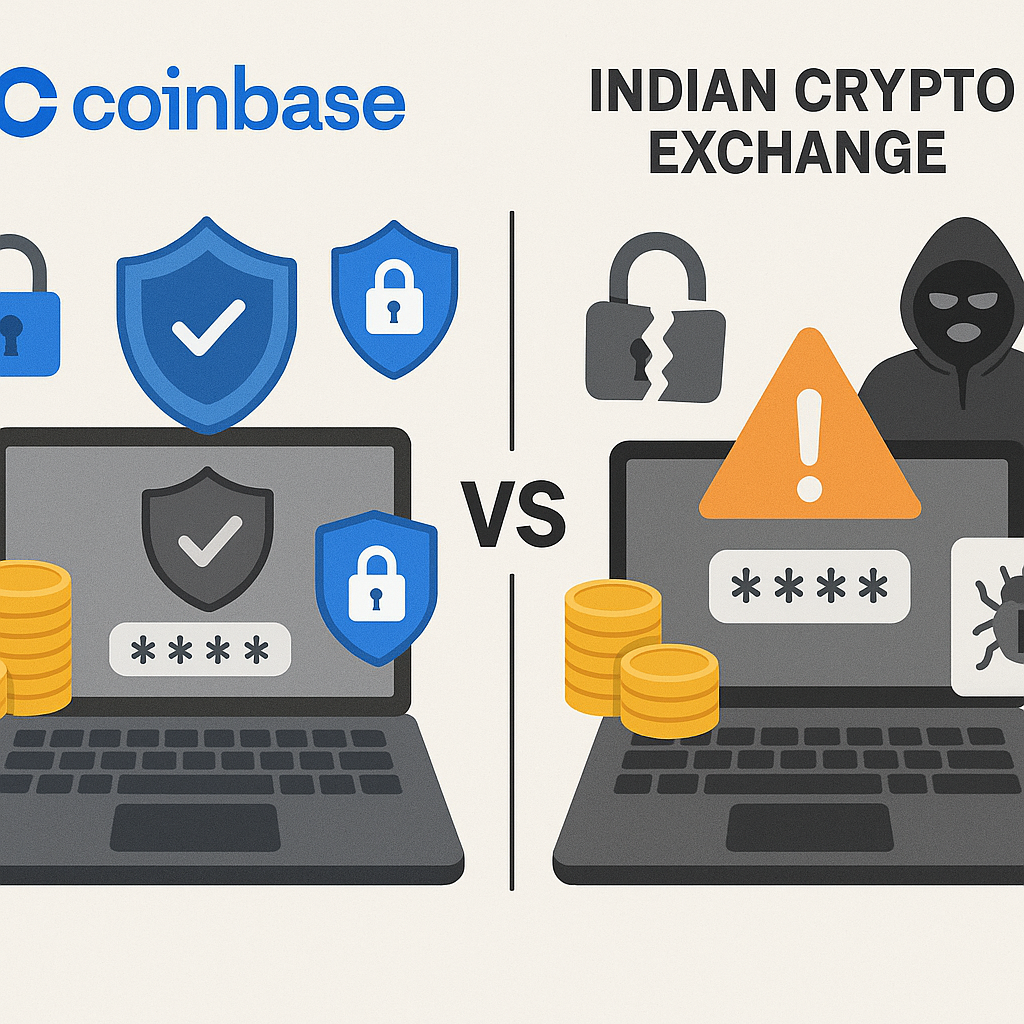

Security Protocols: Coinbase implements robust, globally recognized security measures, whereas Indian exchanges may have varying levels of security sophistication.

Coinbase brings robust fiat onramps (pending local partnerships), deep liquidity pools, and seamless integration with global markets—a trifecta that could lure both retail investors and institutions seeking exposure to digital assets. The entry of such a heavyweight may also force local players to accelerate innovation around compliance tools, user education, and product offerings.

The Ripple Effect Across Asian Crypto Markets

Coinbase’s push into India isn’t happening in isolation—it has significant implications across Asia. As regulatory perceptions shift subtly but surely, other Asian economies are closely watching how India manages this influx of international capital and technology.

If Coinbase succeeds in navigating India’s complex regulatory environment while maintaining compliance and growth, it sets a precedent that could embolden other global exchanges to follow suit—not only in India but also in similarly ambiguous jurisdictions like Indonesia or Vietnam.

Moreover, increased competition could drive down fees for users across the continent while fostering best practices around KYC/AML standards—a win-win for both consumers and regulators striving for balance between innovation and oversight.

Coinbase’s regulatory approval in India is more than a simple market entry; it signals a potential paradigm shift for crypto adoption in Asia. As Coinbase gears up for its relaunch, the platform is poised to challenge local Indian exchanges, intensifying competition and pushing the entire sector toward higher standards of compliance, transparency, and user experience. This move comes at a time when India’s crypto community is hungry for reliable, globally recognized platforms—especially after years of uncertainty and fragmented regulation.

Competitive Ripple Effects: Coinbase vs Indian Exchanges

The arrival of Coinbase could fundamentally alter the landscape for homegrown platforms like WazirX, CoinDCX, and ZebPay. These exchanges have long dominated the domestic market but often face criticism over liquidity issues and limited international reach. By contrast, Coinbase brings deep liquidity pools, advanced trading tools, and a reputation for robust security.

This competitive shake-up will likely drive innovation among Indian exchanges. Expect improved user interfaces, new product offerings (such as staking or DeFi integrations), and better educational resources targeting first-time investors. The increased competition may also force local platforms to accelerate their own compliance efforts with the Financial Intelligence Unit (FIU) requirements—raising industry standards across the board.

Key Differences: Coinbase vs. Indian Crypto Exchanges

-

Regulatory Compliance: Coinbase operates under strict US and international regulations, while many Indian exchanges adapt to evolving local policies.

-

User Interface & Experience: Coinbase is known for its sleek, user-friendly design, whereas Indian platforms often prioritize local payment integration and language support.

-

Asset Listings: Coinbase typically lists a curated selection of major cryptocurrencies, while Indian exchanges may offer a broader range, including regional tokens.

-

Fiat On-Ramp Options: Indian exchanges support INR deposits and withdrawals, leveraging local banking systems, while Coinbase’s INR integration is still developing.

-

Security Infrastructure: Coinbase invests heavily in advanced security protocols and insurance, whereas Indian exchanges vary in their security measures and coverage.

Regulatory Clarity and Market Growth Potential

India’s decision to grant Coinbase regulatory approval comes against a backdrop of evolving global crypto policy. While India still imposes a steep 30% tax on crypto trading gains and lacks comprehensive legislation for digital assets, Coinbase’s entry could catalyze more nuanced discussions around regulation. The presence of such a high-profile player may encourage policymakers to develop clearer guidelines that balance innovation with consumer protection.

This shift would not only benefit retail investors but also attract institutional capital—an area where India has traditionally lagged behind other Asian markets like Singapore or Hong Kong. With Coinbase’s comeback, there’s renewed optimism that India can become a regional hub for blockchain startups, fintech collaborations, and cross-border payments innovation.

Regional Implications: Asia’s Crypto Power Shift

The impact of Coinbase India crypto market expansion will reverberate well beyond national borders. As one of the world’s largest cryptocurrency exchanges integrates with one of its fastest-growing economies, neighboring countries are watching closely. If successful, Coinbase’s model in India could be replicated across other Asian markets where regulatory ambiguity has stifled growth.

This move also aligns with broader trends in Asian fintech: increasing mobile penetration, youthful demographics eager for alternative investments, and governments gradually warming up to digital assets as part of their economic modernization strategies. For investors tracking Coinbase regulatory approval India, this could mark the beginning of deeper integration between Western platforms and Asian users—a true East-meets-West moment in digital finance.

Would you switch from your current Indian crypto exchange to Coinbase if it became available?

Coinbase is making moves to enter the Indian market. We’re curious—would you consider making the switch from your current exchange?

Navigating Challenges Ahead

The road ahead isn’t without obstacles. High taxes remain a significant deterrent for active traders; many are still wary after previous regulatory crackdowns that forced platforms like Coinbase to pause operations in 2023. Furthermore, onboarding millions of new users will require robust customer support infrastructure tailored to local languages and payment systems.

Yet these challenges are not insurmountable—especially if Coinbase leverages its global expertise while partnering with local firms for compliance and outreach initiatives. The next 12 months will be pivotal as we watch whether this bold bet pays off—and if so, how it might reshape not just crypto trading in India 2025, but also the broader narrative around crypto adoption Asia.

The intersection of global ambition and local opportunity is rarely straightforward—but it’s precisely where lasting change often begins.

As policy evolves and competition heats up, all eyes are on how this American giant adapts to one of the world’s most dynamic—and complex—digital asset markets.